What are the sanction lists?

- Canadian Government Office of the Superintendent of Financial Institutions (OSFI)

- European Union Sanctions

- Her Majesty’s (HM) Treasury Sanctions

- New Zealand Police Designated Terrorist Watch list

- Office of Foreign Asset Control Sanctions, SDN’s and Non-SDN’s (OFAC)

- United Nations Sanctions

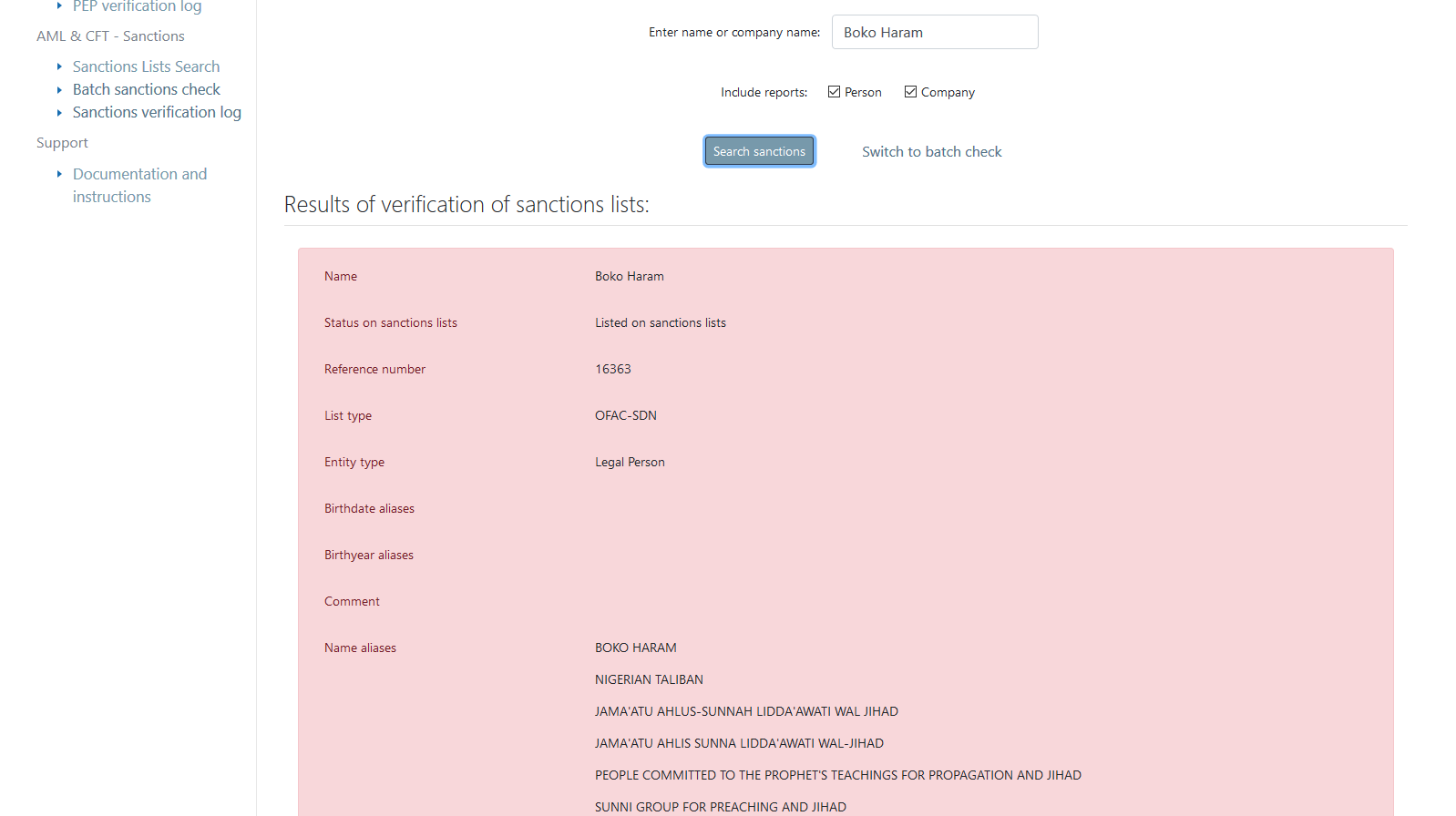

The presence of a sanctions list has many legal consequences, such as a ban on concluding service contracts with such an entity or the rapport of such clients to control authorities depending on your internal risk management process.

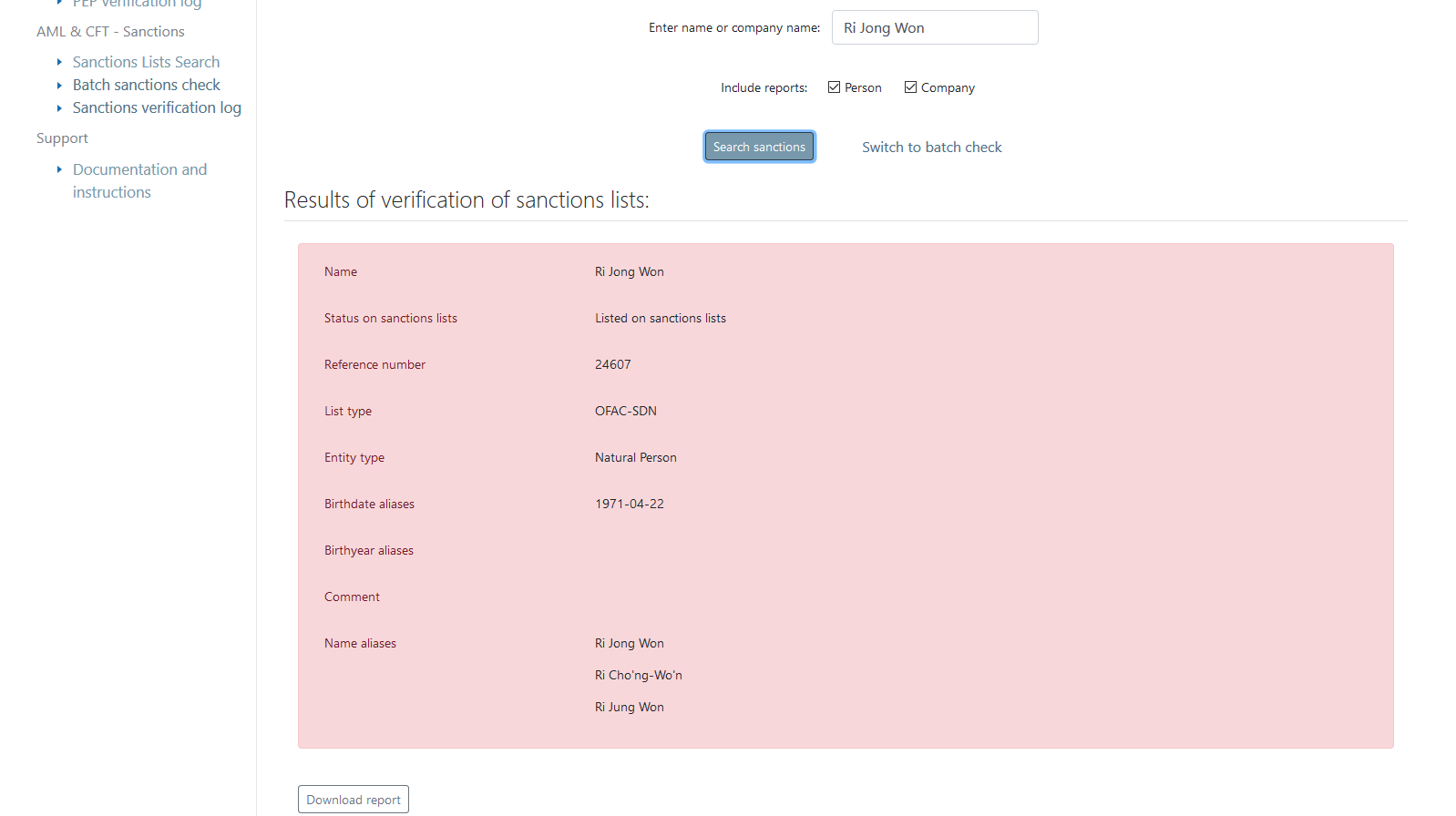

How can I check if my client is on the sanctions list?

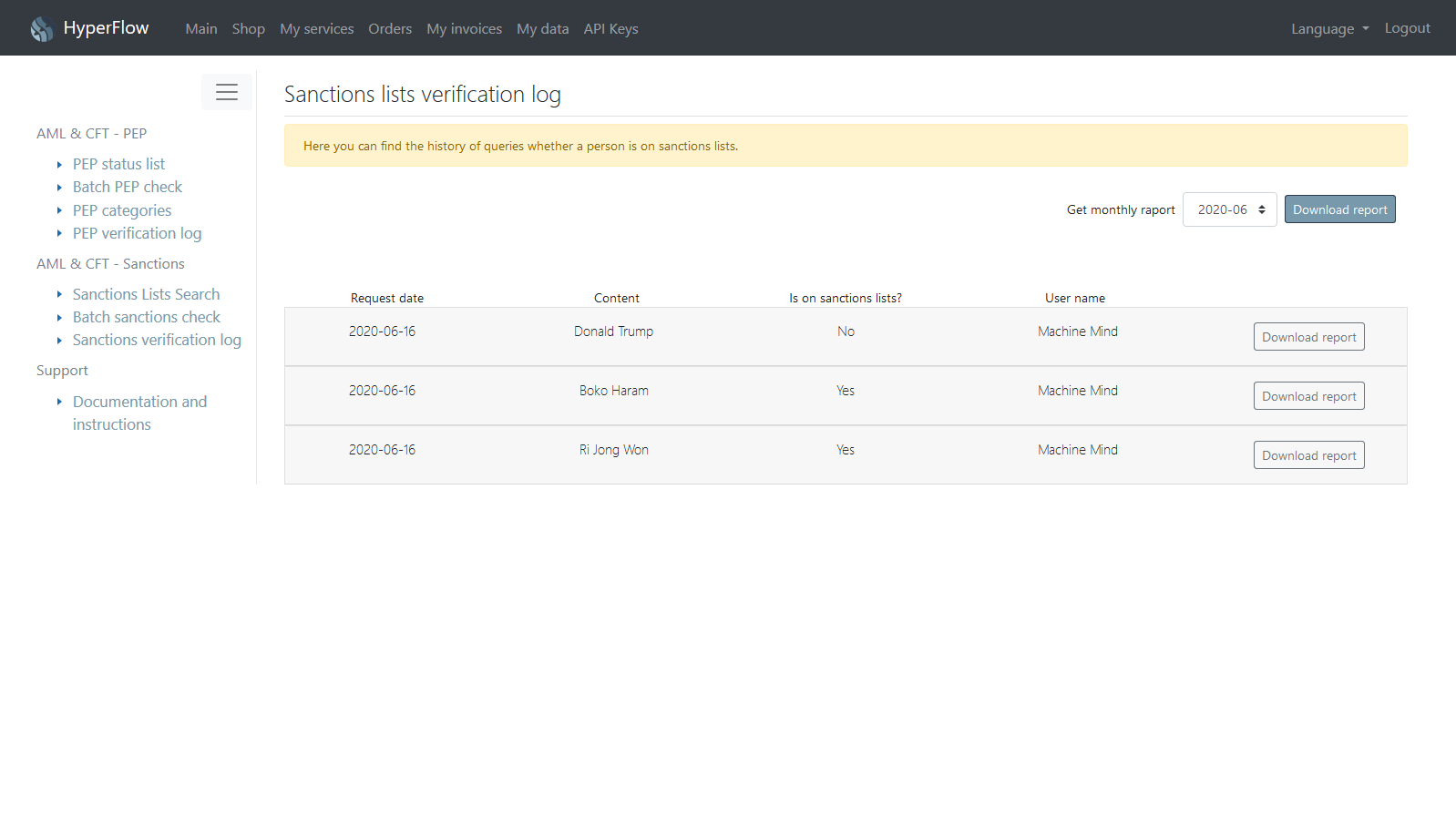

The due diligence procedure requires the obligated institutions to periodically verify their clients on the aforementioned lists. This process should be performed at the beginning of the relationship with the customer (on-boarding) as well as later cyclically during the relationship.

Of course manual, manual verification is a tedious, time-consuming and expensive task. Noteworthy is the fact that the contents of these lists often change.

Why is it worth considering introducing a tool supporting analysis on sanctions lists?

Having a tool that allows automatic verification on sanction lists carries with it undeniably many benefits to which we can include:

- Increasing the speed of analysis itself

- Fulfilling the requirement of cyclic analysis of the customers

- Ensuring that your copies of lists are up to date

- Eliminating the human factor - which can cause mistakes

- Automatic re-analyze the selected customer or the entire customer database when a new version of list is published in a seconds

Where I can find a tool for automatic analysis of my client base on sanctions lists

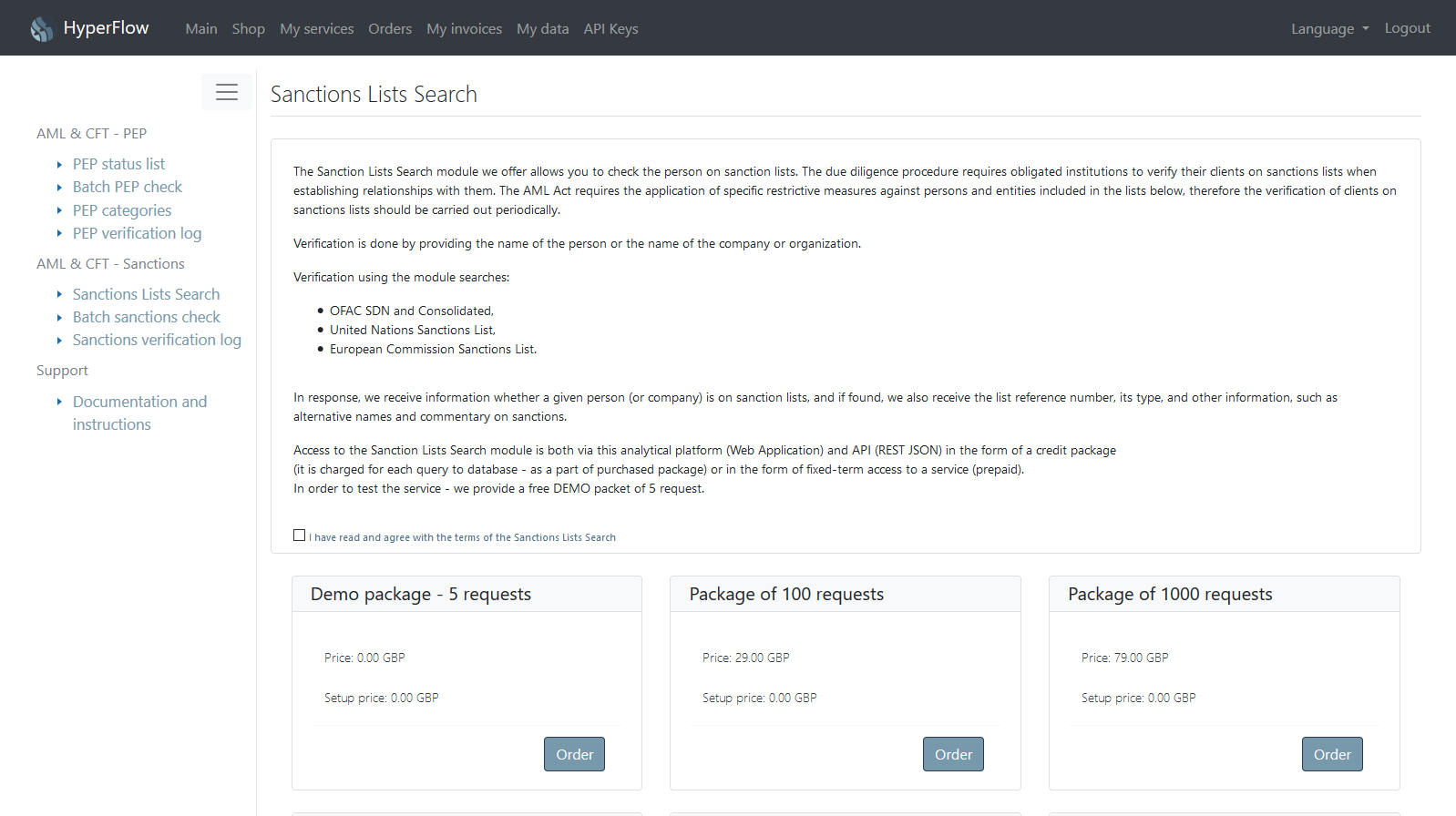

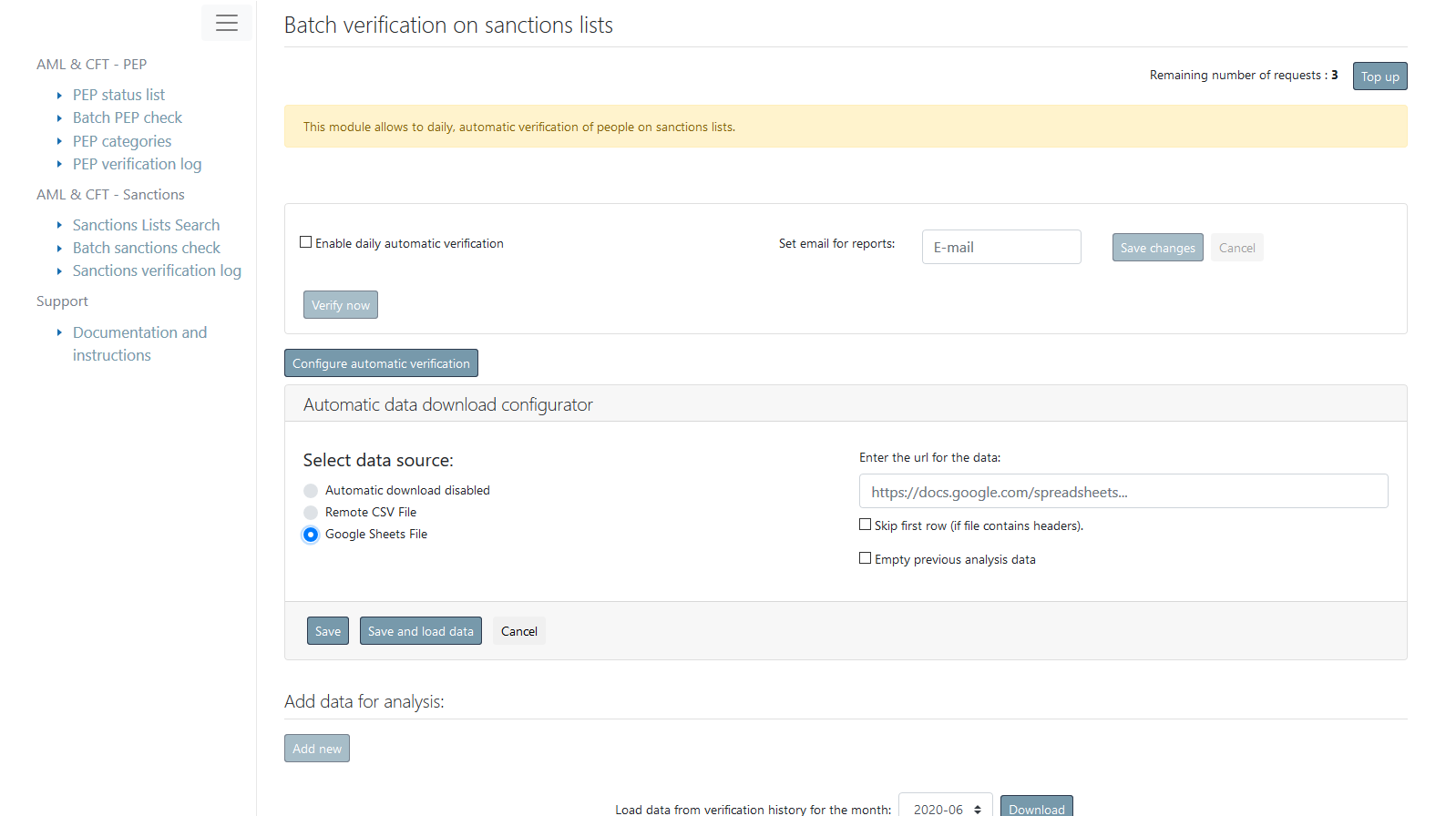

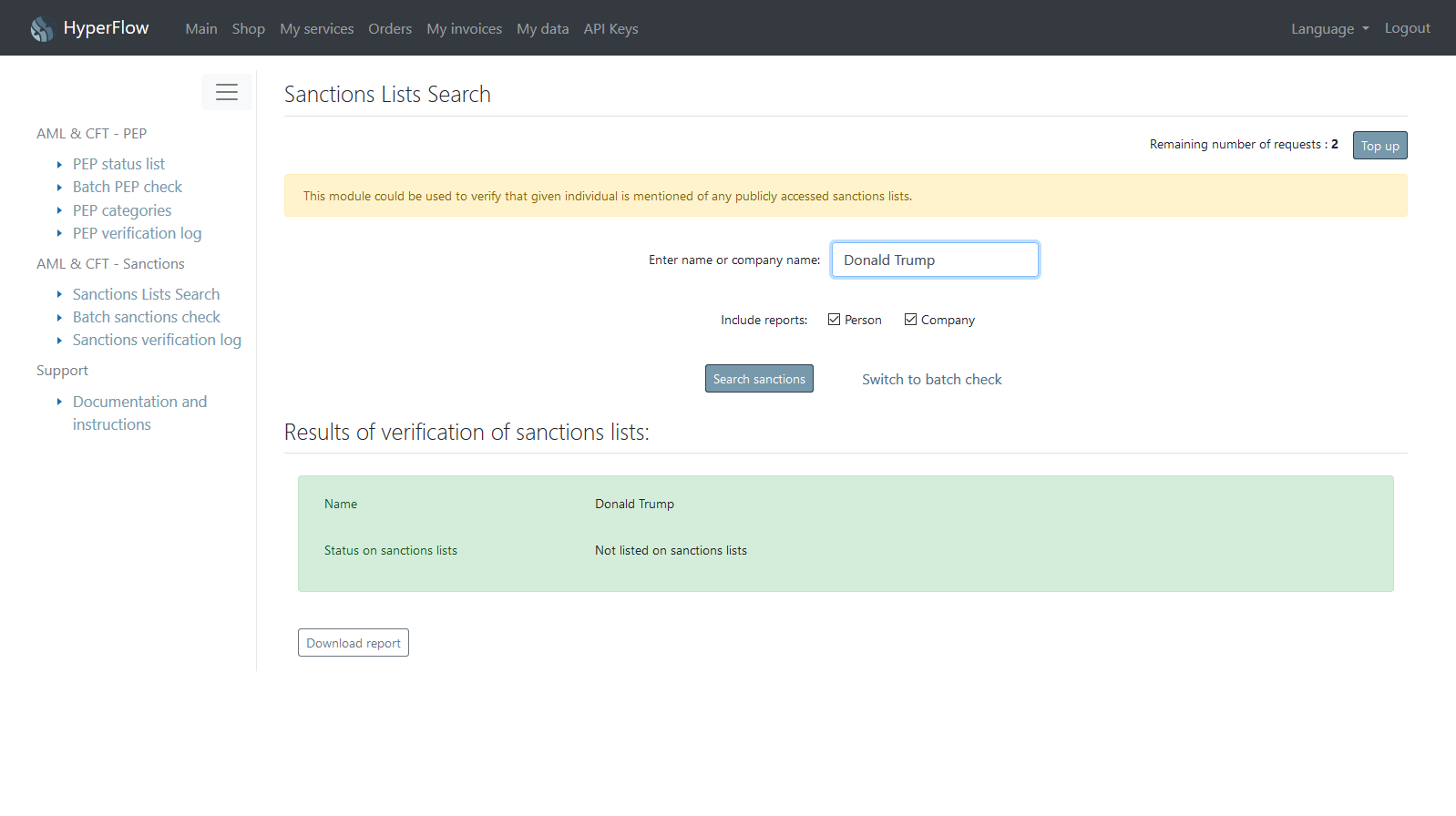

Our company released in 2020 a new fully automated all-in-one powerful sanction screening tool that is available in the integrated HyperFlow platform environment.

The combination of the PEP List module and the Sanctions Lists module in one cloud IT environment will allow you to analyze your clients in terms of PEP risk and sanctions simultaneously.

To test Sanction Screening Tool for free (both API and GUI version) and no obligation - just create a free account on the HyperFlow platform by clicking the button below:

Pricing and all features

The efficiency of our solution has been confirmed by numerous studies in this matter.

The use of the SaaS model significantly reduces the AML & KYC implementation costs.

It is also important that the fees are directly proportional to the number of clients.

Thanks to this, small companies and organizations have a customer verification service at a very low cost.

Enhanced due diligence

CDD - challenges for risk analysis departments

Necessary legal regulations are constantly updated and are changing. An example of new regulations may be the 5th AML directive which was introduced in May 2018.

The new directive adds a number of new obligations and extends the scope of obligated institutions.

We understand the necessity of introducing legislative changes in order to improve the fight against terrorism and finance it.

As the example of previous years shows, for criminal purposes, newer techniques are being used related. Those newer techniques includes virtual currencies exchange and trading outside the banking system .

These threats create the need to prepare even more perfect tools that operate in a synchronized and integrated manner.

Very significant matter is the speed of operation of these systems and reacting in near real time, without unnecessary delays.

The proper fulfillment of due diligence procedures at the beginning of cooperation with the client should be accurate but at the same time fast and not incriminating the compliance departments.

Risk departaments vs IT - integration problems

Risk analysis departments have been using computer programs to support their work for years. New regulation requires new tools or updating existing ones.

Unfortunately, many programs and computer systems used to perform tasks related to AML were created at times where procedures of ensuring due diligence were definitely simpler and did not take into account the currently existing needs.

The reasons for this are obvious - no one could predict what challenges await us nowadays and how the current anti-money laundering regulations will look.

There are 2 options to choose from: we can update existing IT solutions and / or build new ones - based on new guidelines. .

On the one hand, the replacement of existing IT solutions and systems is very expensive. On the other hand, the implementation of additional solutions from different software producers generates some problems related to the integration of applications and systems.

The lack of a comprehensive approach to AML systems architecture generates additional work for compliance departments and often prevents the use of full capabilities that flow from the cooperation of various system components. A common problem is the lack of common data exchange interfaces and the difficulty of data and event synchronization. The reason for such phenomena is usually the lack of specialized flow design and its update, which is crucial.

Nowadays, a comprehensive look at the problem of counteracting money laundering is very important. This is not just a customer analysis on sanction lists or checking PEP status.

A modern analysis of behaviors is also required for comprehensive customer analysis.

In 2019, more and more often we support algorithms based on machine learning and artificial intelligence.

The classical statistical methods are replaced by probabilistic algorithms and the learning of behavioral patterns based on a positive and negative set.

The key problem that the compliance departments are faced is the continuous integration and cooperation of their components.

The more tools we have, the more work should be put into their effective and efficient integration.

Designing comprehensive solutions AML, KYC It is not an easy task and for this reason, you should entrust these tasks to specialists with experience in this field.

Benefits of simultaneous customer analysis on sanction lists and PEP status.

The HyperFlow platform allows you to comply with client analysis obligations with one the integrated cloud environment. Regardless of the nature of the analysis, all tasks are completed in one place.

Thanks to the integration of services, you can achieve a synergy effect.

Instead of many sources of data and separate analyzes in the context of Pep and sanctions lists - you have a comprehensive solution at your disposal.

In our environment there is one central CRM database (data warehouse) containing data about clients, their representatives and ultimate beneficial owners (UBO) . When analyzing sanctions lists or checking Pep status, our solution uses one database that could be accessed for other non-AML tasks.

The benefits of this approach are obvious:- First of all, we have one data write and read point, we do not need to update many databases simultaneously - no more synchronization problems.

- Secondly, we solve the problem of continuous data update in distributed systems.

- Thirdly, one save point saves both space and costs related to the implementation of KYC and AML tasks.

- Fourthly, using one operator reduces the costs of implementing the entire solution.